- Explore MCP Servers

- mcp-financial-coach

Mcp Financial Coach

What is Mcp Financial Coach

The mcp-financial-coach is an AI-powered financial advisor that utilizes Google’s ADK framework to provide personalized financial analysis and recommendations based on user inputs such as income, expenses, debts, and financial goals.

Use cases

Use cases include individuals seeking to improve their financial health, financial advisors looking for tools to assist clients, and educational institutions teaching financial management.

How to use

Users can interact with the mcp-financial-coach through a Streamlit UI, where they input their financial data. The system processes this data through various specialized AI agents to generate comprehensive financial advice.

Key features

Key features include multi-agent financial analysis, structured data flow using Pydantic models, and tailored recommendations for budgeting, savings strategies, and debt reduction.

Where to use

The mcp-financial-coach can be used in personal finance management, financial planning services, and educational platforms focused on financial literacy.

Clients Supporting MCP

The following are the main client software that supports the Model Context Protocol. Click the link to visit the official website for more information.

Overview

What is Mcp Financial Coach

The mcp-financial-coach is an AI-powered financial advisor that utilizes Google’s ADK framework to provide personalized financial analysis and recommendations based on user inputs such as income, expenses, debts, and financial goals.

Use cases

Use cases include individuals seeking to improve their financial health, financial advisors looking for tools to assist clients, and educational institutions teaching financial management.

How to use

Users can interact with the mcp-financial-coach through a Streamlit UI, where they input their financial data. The system processes this data through various specialized AI agents to generate comprehensive financial advice.

Key features

Key features include multi-agent financial analysis, structured data flow using Pydantic models, and tailored recommendations for budgeting, savings strategies, and debt reduction.

Where to use

The mcp-financial-coach can be used in personal finance management, financial planning services, and educational platforms focused on financial literacy.

Clients Supporting MCP

The following are the main client software that supports the Model Context Protocol. Click the link to visit the official website for more information.

Content

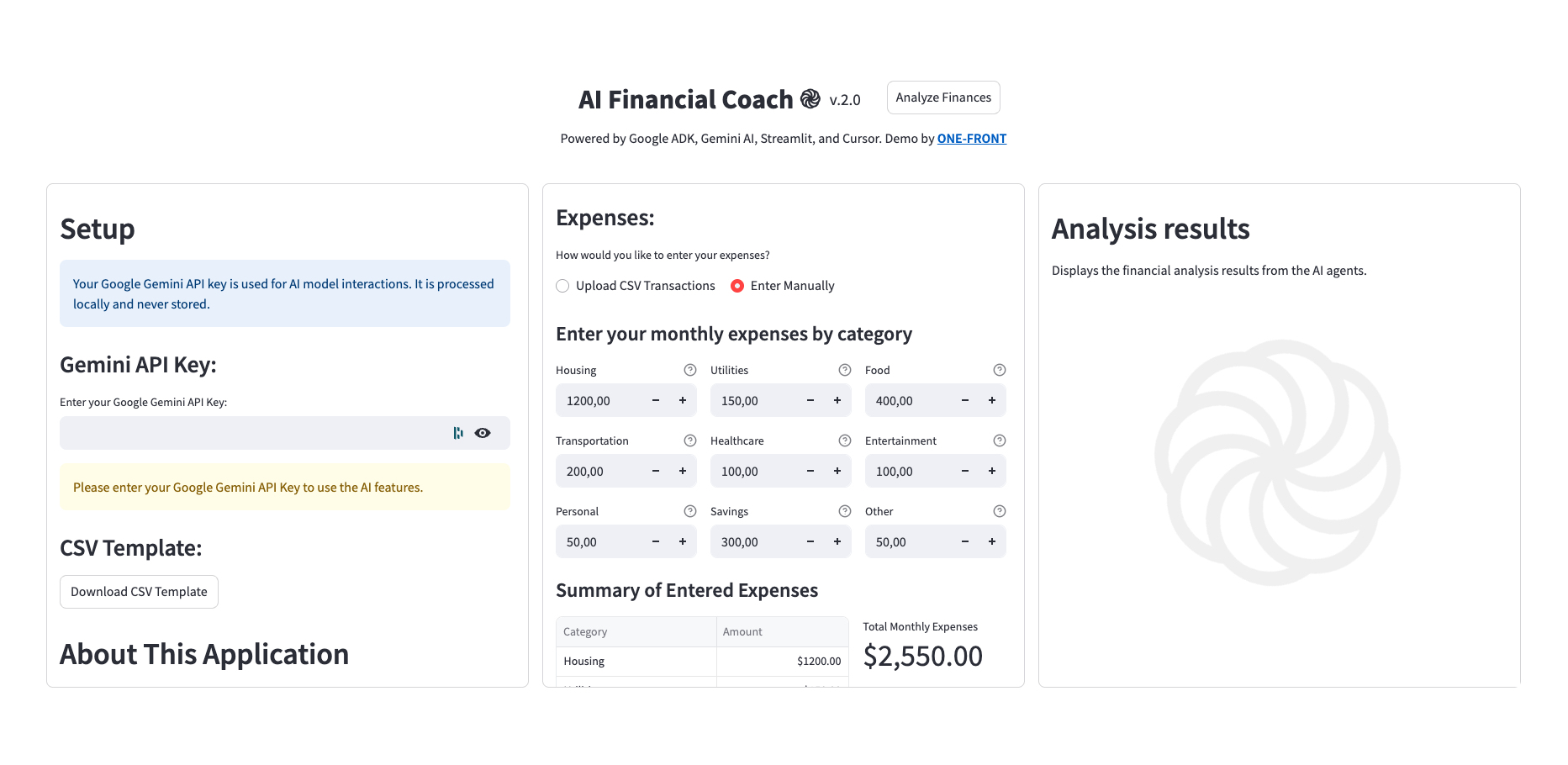

AI Financial Coach ֎

Demo by ONE-FRONT

The AI Financial Coach is a personalized financial advisor powered by Google’s ADK (Agent Development Kit) framework. This app provides comprehensive financial analysis and recommendations based on user inputs including income, expenses, debts, and financial goals.

Table of Contents

Project Architecture

The AI Financial Coach operates on a multi-agent system orchestrated by the FinanceAdvisorSystem. User inputs are processed through a series of specialized AI agents, each focusing on a distinct aspect of financial analysis. The agents communicate and build upon each other’s outputs, utilizing Pydantic models to ensure structured data flow.

graph TD A[User Input] --> B[Streamlit UI]; B --> C[Financial Data Input]; C --> D[FinanceAdvisorSystem]; D --> E[BudgetAnalysisAgent]; E --> F[SavingsStrategyAgent]; F --> G[DebtReductionAgent]; G --> H[Pydantic Models]; H --> I[Analysis Results Display]; style A fill:#ECECFF,stroke:#333,stroke-width:2px; style B fill:#ECECFF,stroke:#333,stroke-width:2px; style C fill:#ECECFF,stroke:#333,stroke-width:2px; style D fill:#f9f,stroke:#333,stroke-width:2px; style E fill:#bbf,stroke:#333,stroke-width:2px; style F fill:#bbf,stroke:#333,stroke-width:2px; style G fill:#bbf,stroke:#333,stroke-width:2px; style H fill:#f2f2f2,stroke:#333,stroke-width:2px; style I fill:#ECECFF,stroke:#333,stroke-width:2px;

Agent Breakdown

The core intelligence of the application resides in a SequentialAgent system, where each agent processes information and passes its refined output to the next, ensuring a comprehensive financial assessment.

-

BudgetAnalysisAgent:- Purpose: The initial agent responsible for a detailed review of financial transactions and expenses.

- Tasks: Analyzes income and spending, categorizes expenses, identifies patterns, and suggests areas for budget improvements with quantified potential savings.

- Model:

gemini-2.0-flash-exp - Output: Generates a

BudgetAnalysisobject, which is stored instate['budget_analysis'].

-

SavingsStrategyAgent:- Purpose: Builds upon the budget analysis to formulate personalized savings plans.

- Tasks: Reviews the

budget_analysis, calculates optimal emergency fund size, suggests savings allocations for various purposes, and recommends automation techniques for consistent saving. - Model:

gemini-2.0-flash-exp - Output: Creates a

SavingsStrategyobject, stored instate['savings_strategy'].

-

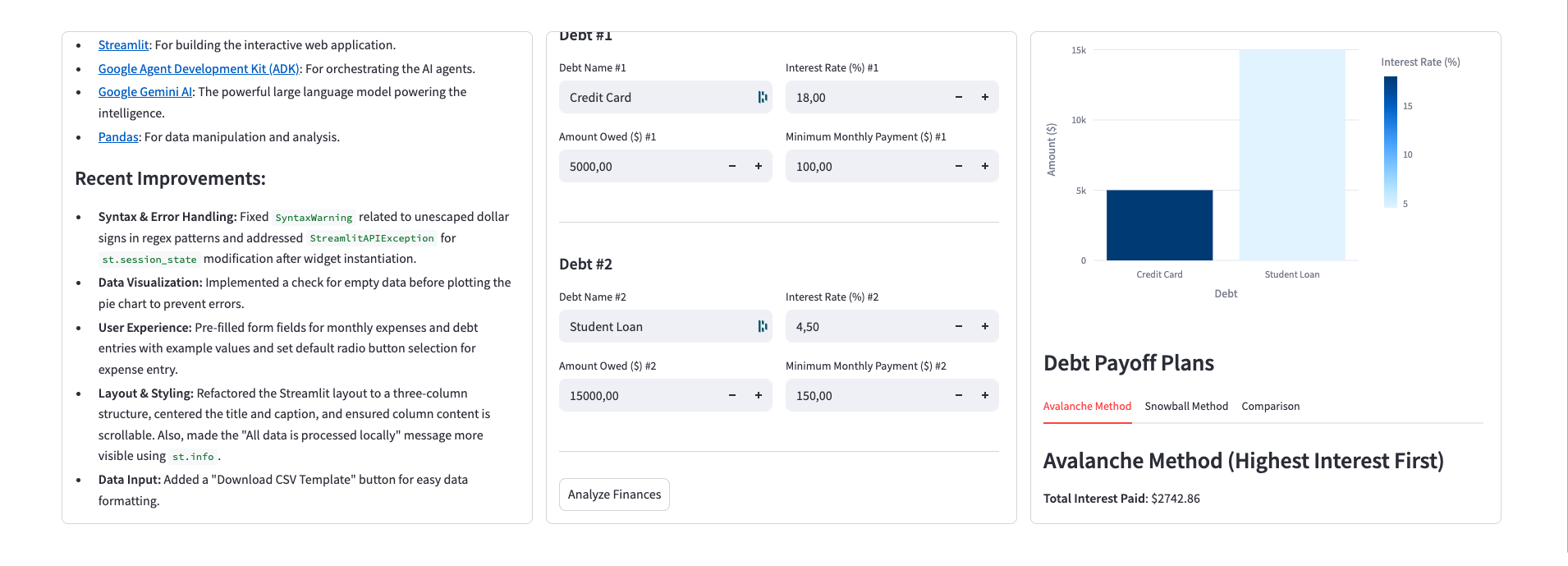

DebtReductionAgent:- Purpose: The final agent, focusing on optimizing debt payoff to minimize interest and accelerate debt freedom.

- Tasks: Analyzes debts (interest rate, balance, minimum payments), creates prioritized payoff plans (avalanche and snowball methods), calculates total interest paid and time to debt freedom, and suggests strategies like consolidation or refinancing.

- Model:

gemini-2.0-flash-exp - Output: Produces a

DebtReductionobject, stored instate['debt_reduction'].

Features

-

Multi-Agent Financial Analysis System

- Budget Analysis Agent: Analyzes spending patterns and recommends optimizations

- Savings Strategy Agent: Creates personalized savings plans and emergency fund strategies

- Debt Reduction Agent: Develops optimized debt payoff strategies using avalanche and snowball methods

-

Enhanced UI/UX:

- Centered main title and application tagline for improved aesthetics.

- Prominent display of data privacy message (“All data is processed locally and not stored anywhere.”).

- Independent scrollable columns for sidebar, input forms, and analysis results, adapting to screen height.

-

Expense Analysis:

- Supports both CSV upload and manual expense entry.

- Includes a “Download CSV Template” button for easy data preparation.

- CSV transaction analysis with date, category, and amount tracking.

- Visual breakdown of spending by category.

- Automated expense categorization and pattern detection.

-

Savings Recommendations:

- Emergency fund sizing and building strategies.

- Custom savings allocations across different goals.

- Practical automation techniques for consistent saving.

- Progress tracking and milestone recommendations.

-

Debt Management:

- Multiple debt handling with interest rate optimization.

- Comparison between avalanche and snowball methods.

- Visual debt payoff timeline and interest savings analysis.

- Actionable debt reduction recommendations.

-

Interactive Visualizations:

- Pie charts for expense breakdown.

- Bar charts for income vs. expenses.

- Debt comparison graphs.

- Progress tracking metrics.

agent.py Structure

The agent.py file is the central hub of the application, responsible for both the Streamlit user interface and the orchestration of the AI agents. Its key sections include:

- Pydantic Models: Defines the data schemas (e.g.,

BudgetAnalysis,SavingsStrategy,DebtReduction) that structure the input and output of the AI agents, ensuring data consistency and validation. FinanceAdvisorSystemClass: This class initializes theInMemorySessionServiceand sets up theLlmAgentinstances for budget analysis, savings strategy, and debt reduction. These individual agents are then combined into aSequentialAgent(FinanceCoordinatorAgent), which manages the flow of information between them. TheRunnerclass is used to execute the agent sequence.analyze_financesMethod: An asynchronous method withinFinanceAdvisorSystemthat takes financial data, creates a session, preprocesses transactions and manual expenses, runs the sequential agent, and retrieves the final analysis results.- Data Preprocessing Functions (

_preprocess_transactions,_preprocess_manual_expenses): Helper methods to prepare user-provided financial data for agent consumption, including parsing CSV transactions and calculating category totals. - Display Functions (

display_budget_analysis,display_savings_strategy,display_debt_reduction): These functions are responsible for rendering the structured output from the AI agents into user-friendly visualizations and text within the Streamlit UI. - Input Rendering Functions (

_render_income_and_dependants,_render_expenses_input,_render_debt_information): Modular functions that create the interactive Streamlit widgets for users to input their financial data. mainFunction: The entry point of the Streamlit application. It configures the page settings, initializes Streamlit session state variables (for persisting data across reruns), checks for the Gemini API key, and lays out the main UI components using Streamlit columns and containers. It also contains the logic to trigger the financial analysis when the “Analyze Finances” button is clicked.

How to Run

Follow the steps below to set up and run the application:

-

Get API Key:

- Get a free Gemini API Key from Google AI Studio: https://aistudio.google.com/apikey

- Create a

.envfile in the project root and add your API key:GOOGLE_API_KEY=your_api_key_here

-

Clone the Repository:

git clone https://github.com/michaelwybraniec/mcp-financial-coach.git cd mcp-financial-coach -

Install Dependencies:

pip install -r requirements.txt -

Run the Streamlit App:

streamlit run agent.py # Alternatively, if running in a virtual environment: # source .venv/bin/activate && streamlit run agent.py

CSV File Format

The application accepts CSV files with the following required columns:

Date: Transaction date in YYYY-MM-DD formatCategory: Expense categoryAmount: Transaction amount (supports currency symbols and comma formatting)

Example:

Date,Category,Amount 2024-01-01,Housing,1200.00 2024-01-02,Food,150.50 2024-01-03,Transportation,45.00

A template CSV file can be downloaded directly from the application’s sidebar.

Key Components

FinanceAdvisorSystem Class

This class orchestrates the various financial analysis agents. It initializes and manages the BudgetAnalysisAgent, SavingsStrategyAgent, and DebtReductionAgent as a sequential agent system.

Agents

-

BudgetAnalysisAgent:- Analyzes income, transactions, and expenses.

- Categorizes spending and identifies patterns.

- Recommends budget improvements and potential savings.

- Uses

gemini-2.0-flash-expmodel. - Output schema:

BudgetAnalysis.

-

SavingsStrategyAgent:- Creates personalized savings plans.

- Calculates optimal emergency fund size.

- Suggests savings allocation and automation techniques.

- Uses

gemini-2.0-flash-expmodel. - Output schema:

SavingsStrategy.

-

DebtReductionAgent:- Manages multiple debts and optimizes payoff strategies.

- Compares avalanche and snowball methods.

- Provides actionable debt reduction recommendations.

- Uses

gemini-2.0-flash-expmodel. - Output schema:

DebtReduction.

Pydantic Models

The project heavily utilizes Pydantic for data validation and clear schema definition for agent outputs:

SpendingCategorySpendingRecommendationBudgetAnalysisEmergencyFundSavingsRecommendationAutomationTechniqueSavingsStrategyDebtPayoffPlanPayoffPlansDebtRecommendationDebtReduction

These models ensure structured and consistent data flow between the agents and the Streamlit UI.

Future Enhancements

- Database Integration: Implement a database (e.g., SQLite, PostgreSQL) to persist user data, transaction history, and financial plans.

- User Authentication: Add user login and registration to allow multiple users to manage their finances securely.

- Advanced Categorization: Integrate with a more robust financial data API for automatic and intelligent transaction categorization.

- Investment Planning Agent: Develop a new agent to provide personalized investment advice based on user risk tolerance and financial goals.

- Real-time Data Sync: Connect to bank accounts or financial institutions for real-time transaction updates.

- Mobile Responsiveness: Optimize the Streamlit UI for better display and interaction on mobile devices.

Dev Tools Supporting MCP

The following are the main code editors that support the Model Context Protocol. Click the link to visit the official website for more information.