- Explore MCP Servers

- mcportfolio

Mcportfolio

What is Mcportfolio

McPortfolio is a Model Context Protocol server that provides 9 specialized tools for portfolio optimization driven by Large Language Models (LLMs). It enables users to perform advanced portfolio optimization using natural language without the need for coding.

Use cases

Use cases for McPortfolio include: 1) Individual investors seeking to optimize their investment portfolios based on personal risk tolerance; 2) Financial advisors providing tailored portfolio recommendations for clients; 3) Portfolio managers using advanced optimization techniques to enhance fund performance.

How to use

Users can interact with McPortfolio through a user-friendly interface, where they can input their investment preferences and constraints in natural language. The server processes these inputs and utilizes its specialized tools to generate optimized portfolio recommendations.

Key features

Key features of McPortfolio include: 1) 9 specialized optimization tools covering various methods from mean-variance to machine learning; 2) No coding required, allowing users to optimize portfolios using natural language; 3) Universal solver interface for Model-Constraint-Problem (MCP); 4) Support for diverse risk measures and optimization approaches.

Where to use

McPortfolio can be used in finance and investment sectors, particularly by individual investors, financial advisors, and portfolio managers looking to optimize asset allocation and manage investment risks effectively.

Overview

What is Mcportfolio

McPortfolio is a Model Context Protocol server that provides 9 specialized tools for portfolio optimization driven by Large Language Models (LLMs). It enables users to perform advanced portfolio optimization using natural language without the need for coding.

Use cases

Use cases for McPortfolio include: 1) Individual investors seeking to optimize their investment portfolios based on personal risk tolerance; 2) Financial advisors providing tailored portfolio recommendations for clients; 3) Portfolio managers using advanced optimization techniques to enhance fund performance.

How to use

Users can interact with McPortfolio through a user-friendly interface, where they can input their investment preferences and constraints in natural language. The server processes these inputs and utilizes its specialized tools to generate optimized portfolio recommendations.

Key features

Key features of McPortfolio include: 1) 9 specialized optimization tools covering various methods from mean-variance to machine learning; 2) No coding required, allowing users to optimize portfolios using natural language; 3) Universal solver interface for Model-Constraint-Problem (MCP); 4) Support for diverse risk measures and optimization approaches.

Where to use

McPortfolio can be used in finance and investment sectors, particularly by individual investors, financial advisors, and portfolio managers looking to optimize asset allocation and manage investment risks effectively.

Content

// Modified by Edward Brandler, based on original files from PyPortfolioOpt and USolver

McPortfolio - LLM-Driven Portfolio Optimization

McPortfolio - LLM-Driven Portfolio Optimization

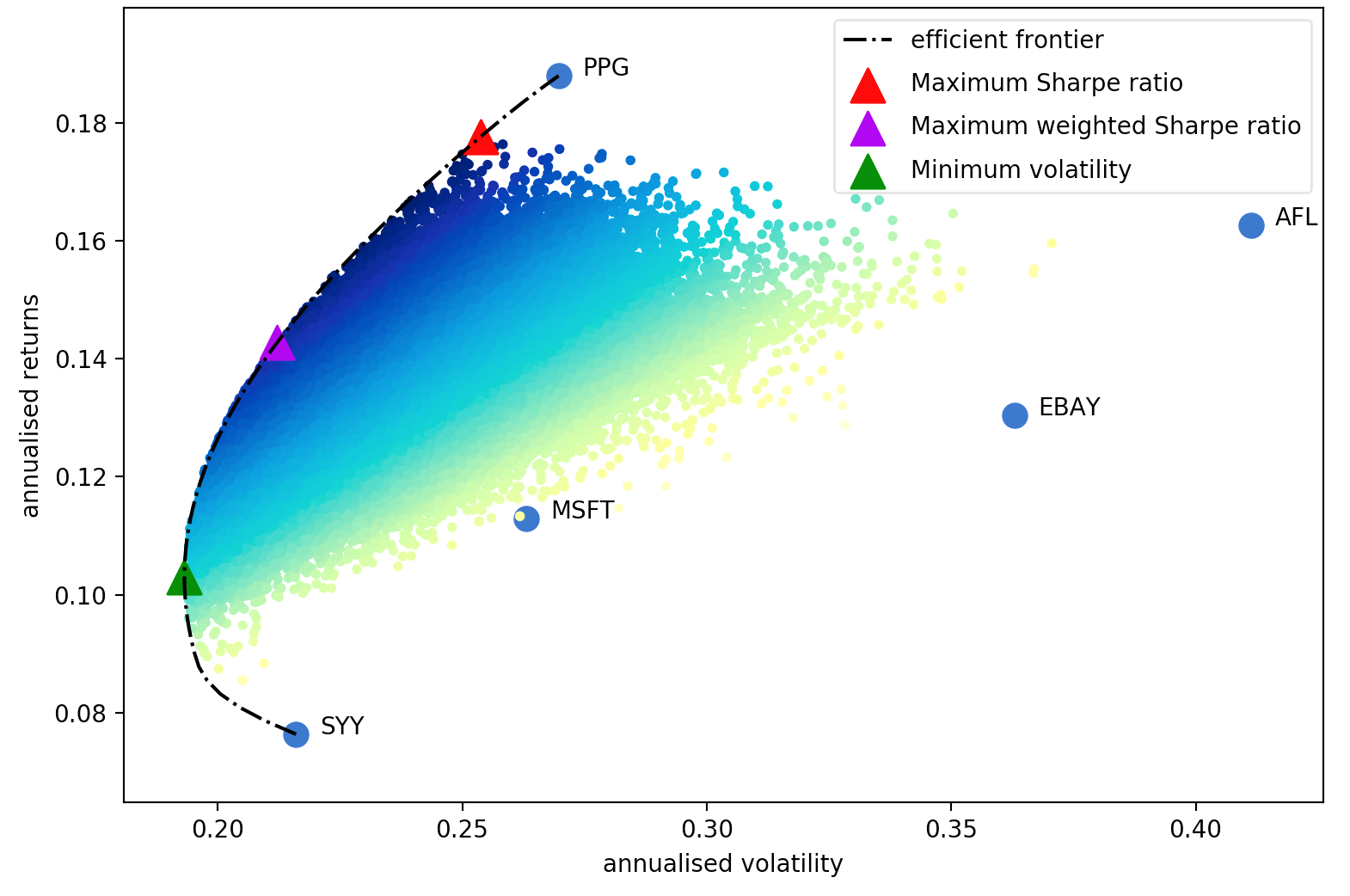

This project allows users to work with advanced portfolio optimization using natural language, without writing code. It provides 9 specialized MCP tools covering everything from classic mean-variance optimization to modern machine learning approaches like Hierarchical Risk Parity.

Overview of Portfolio Optimizers:

Portfolio optimizers are algorithms and mathematical tools designed to help investors allocate their capital among different assets in a way that balances risk and return. The most common approaches include:

- Mean-Variance Optimization (Markowitz): Finds the portfolio with the lowest risk for a given expected return, or the highest return for a given risk, based on historical means and covariances.

- Maximum Sharpe Ratio: Seeks the portfolio with the best risk-adjusted return, maximizing the Sharpe ratio.

- Minimum Volatility: Focuses on constructing the portfolio with the lowest possible volatility.

- Efficient Frontier: The set of optimal portfolios that offer the highest expected return for a defined level of risk.

- Black-Litterman Model: Combines market equilibrium with investor views to produce more stable and realistic portfolios.

- Hierarchical Risk Parity (HRP): Uses clustering algorithms to build diversified portfolios that are robust to estimation errors.

- Mean-CVaR and Mean-Semivariance: Alternative risk measures that focus on downside risk or tail risk, rather than standard deviation.

These optimizers allow users to tailor their portfolios to their specific risk tolerance, investment goals, and market views.

It gives a universal solver interface for Model-Constraint-Problem (MCP). It makes the PyPortfolioOpt library’s features available to Large Language Models (LLMs) through an MCP Server. The main goal is to let .

This project builds on the open-source USolver project, which gives a Model Context Protocol server with tools for different optimization problems. Through USolver, this project works with this powerful solver:

cvxpy- Used for convex optimization problems in portfolio theory, like maximizing Sharpe ratio or minimizing volatility with linear and quadratic constraints.

Important Points for LLM-Driven Optimization

The LLM’s ability to pick the right solver, parameters, and variables for an optimization problem is a judgment call. It is affected by the non-deterministic nature of LLMs.

Users should check both the LLM’s assumptions and the output.

How to Check:

- Review the LLM’s prompt and generated code/parameters: Before running, look at the input the LLM is making for the MCP server.

- Check server logs: The MCP server gives detailed logs of operations and parameters used. Review these logs to make sure they match your goals.

- Compare with PyPortfolioOpt documentation: If you know PyPortfolioOpt, check the LLM’s chosen parameters and objectives against the library’s official docs.

- Look at the output metrics: Check the expected annual return, annual volatility, Sharpe ratio, and other performance metrics to make sure they make sense for your problem.

Claude Project Instructions

Best practise is to run McPortfolio in a Claude Project. This allows you to set project knowledge, which will improve performance.

There’s presently (2025-06-09) no way to force Claude to use a specific tool via MCP Server. So to nudge Claude in the right direction, you can explicitly tell it which tool to use. But even then, you may face issues.

So to help Claude better understand the tools’ purposes and how to use them, copy and paste the contents of docs/Claude_Project_Instructions.md to your Claude project’s knowledge section. Queries then run from within the project will run more smoothly.

The instructions help Claude to:

- Find when a request fits McPortfolio’s features

- Make proper requests using the standard JSON format

- Check outputs against financial best practices

- Give clear explanations of its optimization choices

An overview of classical portfolio optimization methods

Reproduced and adapted from PyPortfolioOpt by robertmartin8

Harry Markowitz’s 1952 paper is the undeniable classic, which turned portfolio optimization from an art into a science. The key insight is that by combining assets with different expected returns and volatilities, one can decide on a mathematically optimal allocation which minimises the risk for a target return – the set of all such optimal portfolios is referred to as the efficient frontier.

Although much development has been made in the subject, more than half a century later, Markowitz’s core ideas are still fundamentally important and see daily use in many portfolio management firms. The main drawback of mean-variance optimization is that the theoretical treatment requires knowledge of the expected returns and the future risk-characteristics (covariance) of the assets. Obviously, if we knew the expected returns of a stock life would be much easier, but the whole game is that stock returns are notoriously hard to forecast. As a substitute, we can derive estimates of the expected return and covariance based on historical data – though we do lose the theoretical guarantees provided by Markowitz, the closer our estimates are to the real values, the better our portfolio will be.

Thus this project provides four major sets of functionality (though of course they are intimately related):

- Estimates of expected returns

- Estimates of risk (i.e covariance of asset returns)

- Objective functions to be optimized

- Optimizers

A key design goal of PyPortfolioOpt is modularity – the user should be able to swap in their components while still making use of the framework that PyPortfolioOpt provides.

Available MCP Tools

McPortfolio provides a comprehensive suite of portfolio optimization tools through the Model Context Protocol (MCP) server. Each tool is designed for specific optimization scenarios and can be used independently or in combination.

Core Tools

1. retrieve_stock_data

Retrieves historical stock market data for analysis.

Parameters:

tickers: List of stock symbols (e.g., [“AAPL”, “MSFT”, “GOOGL”])period: Time period for data (e.g., “1y”, “2y”, “5y”)

Use Case: Data collection for any portfolio optimization analysis.

2. solve_portfolio

General-purpose portfolio optimization with flexible constraints and objectives.

Parameters:

description: Problem descriptiontickers: List of stock symbolsconstraints: List of constraint strings (e.g., [“max_weight 0.3”, “min_weight 0.05”])objective: Optimization objective (“minimize_volatility”, “maximize_sharpe_ratio”, etc.)

Use Case: Most common portfolio optimization scenarios with custom constraints.

Specialized Optimization Methods

3. solve_efficient_frontier

Classic Markowitz mean-variance optimization for maximum Sharpe ratio portfolios.

Parameters:

description: Problem descriptiontickers: List of stock symbolsmin_weight: Minimum weight per asset (default: 0.0)max_weight: Maximum weight per asset (default: 1.0)risk_free_rate: Risk-free rate for Sharpe calculation (default: 0.0)

Use Case: Traditional mean-variance optimization, ideal for well-diversified portfolios.

4. solve_cla

Critical Line Algorithm for efficient frontier computation.

Parameters:

description: Problem descriptiontickers: List of stock symbolsmin_weight: Minimum weight per asset (default: 0.0)max_weight: Maximum weight per asset (default: 1.0)risk_free_rate: Risk-free rate for Sharpe calculation (default: 0.0)

Use Case: Efficient computation of the entire efficient frontier, useful for risk-return analysis.

5. solve_hierarchical_portfolio

Hierarchical Risk Parity (HRP) optimization using machine learning clustering.

Parameters:

description: Problem descriptiontickers: List of stock symbolsmin_weight: Minimum weight per asset (default: 0.0)max_weight: Maximum weight per asset (default: 1.0)risk_free_rate: Risk-free rate for Sharpe calculation (default: 0.0)

Use Case: Modern portfolio construction that addresses estimation errors in traditional optimization.

6. solve_black_litterman

Black-Litterman model combining market equilibrium with investor views.

Parameters:

description: Problem descriptiontickers: List of stock symbolsviews: List of investor views with expected returns and confidence levelsrisk_aversion: Risk aversion parameter (default: 1.0)tau: Scaling factor for uncertainty (default: 0.05)

Use Case: Incorporating market views and expert opinions into portfolio optimization.

Utility Tools

7. solve_discrete_allocation

Converts portfolio weights to actual share quantities for implementation.

Parameters:

description: Problem descriptiontickers: List of stock symbolsweights: Dictionary of target weights (e.g., {“AAPL”: 0.4, “MSFT”: 0.6})portfolio_value: Total portfolio value in dollars

Use Case: Converting theoretical weights to practical share allocations for trading.

8. solve_cvxpy_problem

Advanced custom optimization using CVXPY for complex constraints.

Parameters:

problem: CVXPY problem specification with variables, constraints, and objectives

Use Case: Custom optimization problems that require advanced mathematical formulations.

9. simple_cvxpy_solver

Simplified CVXPY interface for basic optimization problems.

Parameters:

variables: List of optimization variablesobjective_type: “minimize” or “maximize”objective_expr: Objective function expressionconstraints: List of constraint expressionsdescription: Problem description

Use Case: Simple custom optimization without complex CVXPY knowledge.

Tool Selection Guide

Choose the right tool based on your optimization needs:

| Scenario | Recommended Tool | Why |

|---|---|---|

| General portfolio optimization | solve_portfolio |

Most flexible, supports various constraints and objectives |

| Classic mean-variance optimization | solve_efficient_frontier |

Standard Markowitz approach, well-tested |

| Risk parity / diversification focus | solve_hierarchical_portfolio |

Modern approach, robust to estimation errors |

| Efficient frontier analysis | solve_cla |

Efficient computation of entire frontier |

| Incorporating market views | solve_black_litterman |

Combines equilibrium with expert opinions |

| Converting weights to shares | solve_discrete_allocation |

Practical implementation of theoretical weights |

| Custom mathematical constraints | solve_cvxpy_problem |

Maximum flexibility for complex problems |

| Simple custom optimization | simple_cvxpy_solver |

Easy interface for basic custom problems |

When to Use Each Method

Traditional Approaches:

- Efficient Frontier: When you want to understand risk-return tradeoffs

- CLA: When you need the complete efficient frontier efficiently

- General Portfolio: When you have specific constraints or objectives

Modern Approaches:

- HRP: When you have many assets and want robust diversification

- Black-Litterman: When you have market views or want to incorporate expert opinions

Practical Implementation:

- Discrete Allocation: Always use after optimization to convert to actual shares

Portfolio Optimization Examples

The server provides two main endpoints for portfolio optimization. Here are comprehensive examples for different scenarios:

1. Basic Portfolio Optimization

# Example 1: Simple minimum volatility portfolio

{

"description": "Build a minimum volatility portfolio",

"tickers": ["AAPL", "MSFT", "NVDA", "GOOGL", "META"],

"constraints": ["max_weight 0.3"], # No single stock exceeds 30%

"objective": "minimize_volatility"

}

# Example 2: Maximum Sharpe ratio portfolio

{

"description": "Build a maximum Sharpe ratio portfolio",

"tickers": ["AAPL", "MSFT", "NVDA", "GOOGL", "META"],

"constraints": ["max_weight 0.3"],

"objective": "maximize_sharpe_ratio"

}

2. Sector-Constrained Portfolio

# Example: Diversified portfolio across major sectors

{

"description": "Build a diversified portfolio across major sectors",

"tickers": [

# Technology

"AAPL", "MSFT", "NVDA", "GOOGL", "META",

# Financials

"JPM", "V", "BAC", "GS", "AXP",

# Healthcare

"JNJ", "UNH", "PFE", "MRK", "ABBV",

# Consumer

"MCD", "PG", "KO", "WMT", "SBUX",

# Energy

"XOM", "CVX"

],

"constraints": [

"max_weight 0.15", # No single stock exceeds 15%

"sector_tech 0.35", # Technology sector max 35%

"sector_fin 0.35", # Financial sector max 35%

"sector_health 0.35", # Healthcare sector max 35%

"sector_cons 0.35", # Consumer sector max 35%

"sector_energy 0.35" # Energy sector max 35%

],

"objective": "minimize_volatility"

}

3. Risk-Constrained Portfolio

# Example: Portfolio with risk constraints

{

"description": "Build a portfolio with risk constraints",

"tickers": ["AAPL", "MSFT", "NVDA", "GOOGL", "META", "JPM", "V", "JNJ", "UNH"],

"constraints": [

"max_weight 0.2", # No single stock exceeds 20%

"min_weight 0.05", # Each stock must have at least 5%

"max_volatility 0.15" # Maximum portfolio volatility of 15%

],

"objective": "maximize_sharpe_ratio"

}

4. Factor-Constrained Portfolio

# Example: Portfolio with factor constraints

{

"description": "Build a portfolio with factor constraints",

"tickers": ["AAPL", "MSFT", "NVDA", "GOOGL", "META", "JPM", "V", "JNJ", "UNH"],

"constraints": [

"max_weight 0.2", # No single stock exceeds 20%

"min_weight 0.05", # Each stock must have at least 5%

"max_beta 1.2", # Maximum portfolio beta of 1.2

"min_momentum 0.1", # Minimum momentum factor exposure

"max_value 0.3" # Maximum value factor exposure

],

"objective": "maximize_sharpe_ratio"

}

5. Custom Risk Measures

# Example: Portfolio with custom risk measures

{

"description": "Build a portfolio with custom risk measures",

"tickers": ["AAPL", "MSFT", "NVDA", "GOOGL", "META", "JPM", "V", "JNJ", "UNH"],

"constraints": [

"max_weight 0.2", # No single stock exceeds 20%

"max_cvar 0.1", # Maximum Conditional Value at Risk of 10%

"max_cdar 0.15", # Maximum Conditional Drawdown at Risk of 15%

"max_semivariance 0.12" # Maximum semivariance of 12%

],

"objective": "minimize_volatility"

}

6. Hierarchical Risk Parity (HRP) Portfolio

# Example: HRP portfolio for risk parity

{

"description": "Build HRP portfolio for risk parity across sectors",

"tickers": [

"AAPL", "MSFT", "GOOGL", # Tech

"JPM", "V", "BAC", # Finance

"JNJ", "UNH", "PFE", # Healthcare

"PG", "KO", "WMT" # Consumer

],

"min_weight": 0.02,

"max_weight": 0.25,

"risk_free_rate": 0.02

}

7. Critical Line Algorithm (CLA) Portfolio

# Example: CLA optimization for efficient frontier analysis

{

"description": "Optimize tech portfolio using CLA",

"tickers": ["AAPL", "MSFT", "GOOGL", "NVDA", "META"],

"min_weight": 0.05,

"max_weight": 0.4,

"risk_free_rate": 0.025

}

8. Discrete Allocation Example

# Example: Convert weights to actual shares

{

"description": "Allocate $50,000 based on optimized weights",

"tickers": ["AAPL", "MSFT", "GOOGL", "NVDA"],

"weights": {

"AAPL": 0.35,

"MSFT": 0.30,

"GOOGL": 0.20,

"NVDA": 0.15

},

"portfolio_value": 50000

}

9. Black-Litterman with Market Views

# Example: Black-Litterman with investor views

{

"description": "Portfolio with bullish view on tech, bearish on energy",

"tickers": ["AAPL", "MSFT", "GOOGL", "XOM", "CVX", "JPM", "V"],

"views": [

{

"assets": ["AAPL", "MSFT", "GOOGL"],

"expected_return": 0.15,

"confidence": 0.8,

"description": "Tech sector outperformance"

},

{

"assets": ["XOM", "CVX"],

"expected_return": 0.05,

"confidence": 0.6,

"description": "Energy sector underperformance"

}

],

"risk_aversion": 2.5,

"tau": 0.025

}

10. Modern Portfolio Theory (USolver Example)

This project uses USolver for different optimization problems. Here’s how it works for a Modern Portfolio Theory problem, turned by the language model into a convex optimization problem that cvxpy can solve:

Goal: Get the highest expected portfolio return Rules: Bonds cannot be more than 40% Stocks cannot be more than 60% Real Estate cannot be more than 30% Commodities cannot be more than 20% All amounts must be zero or positive Total must be exactly 100% Total weighted portfolio risk cannot be more than 10% Given Data: Expected returns: Bonds 8%, Stocks 12%, Real Estate 10%, Commodities 15% Risk factors: Bonds 2%, Stocks 15%, Real Estate 8%, Commodities 20%

The language model turns this into a convex optimization problem for cvxpy.

$$

\begin{align}

\text{maximize} \quad & 0.08x_1 + 0.12x_2 + 0.10x_3 + 0.15x_4 \

\text{subject to} \quad & x_1 + x_2 + x_3 + x_4 = 1 \

& x_1 \leq 0.4 \

& x_2 \leq 0.6 \

& x_3 \leq 0.3 \

& x_4 \leq 0.2 \

& 0.02x_1 + 0.15x_2 + 0.08x_3 + 0.20x_4 \leq 0.10 \

& x_1, x_2, x_3, x_4 \geq 0

\end{align}

$$

Where:

- $x_1$ = Bonds amount

- $x_2$ = Stocks amount

- $x_3$ = Real Estate amount

- $x_4$ = Commodities amount

The answer is:

Bonds: 30.0% Stocks: 20.0% Real Estate: 30.0% (at maximum allowed) Commodities: 20.0% (at maximum allowed) Maximum Expected Return: 10.8% annually

Installation

You can install the project using:

uv run install.py

This will install all dependencies and development tools.

To uninstall the project:

uv run uninstall.py

This will remove the project and clean up build artifacts.

Prerequisites

- Python 3.12 or higher

- uv package manager

- Git

Development Setup

-

Clone the repository:

git clone https://github.com/ebrandler/mcportfolio cd mcportfolio -

Create and activate a virtual environment:

python -m venv .venv source .venv/bin/activate # On Windows: .venv\Scripts\activate -

Install development dependencies:

uv pip install -e ".[dev]" -

Install pre-commit hooks:

pre-commit install

Running the Server

For Claude Desktop/MCP clients (stdio transport):

uv run mcportfolio/server/main.py

For HTTP/web deployment:

uvicorn mcportfolio.server.main:asgi_app --host 0.0.0.0 --port 8001

The HTTP server will be available at http://localhost:8001

Test the HTTP server health:

curl http://localhost:8001/health

Docker Usage

Building the Image

-

Build the Docker image:

docker build -t mcportfolio:latest . -

Run the container:

docker run -d -p 8001:8001 --name mcportfolio mcportfolio:latest -

Check container status:

docker ps docker logs mcportfolio -

Test the HTTP server:

curl http://localhost:8001/health

Docker Compose (Optional)

For development with Docker Compose:

-

Start the services:

cd infra docker-compose up -d -

View logs:

docker-compose logs -f -

Stop services:

docker-compose down

Health Checks

The container includes a health check that runs every 30 seconds. You can monitor the health status:

docker inspect --format='{{.State.Health.Status}}' mcportfolio

Development

Code Quality

The project uses several tools to maintain code quality:

blackfor code formattingrufffor lintingmypyfor type checkingpytestfor testingpre-commithooks for automated checks

Run all checks:

pre-commit run --all-files

Testing

Run tests with coverage:

pytest --cov=mcportfolio

Generate coverage report:

pytest --cov=mcportfolio --cov-report=html

Quick Reference

Available MCP Tools Summary

| Tool | Purpose | Key Parameters |

|---|---|---|

retrieve_stock_data |

Get market data | tickers, period |

solve_portfolio |

General optimization | tickers, constraints, objective |

solve_efficient_frontier |

Markowitz optimization | tickers, min_weight, max_weight |

solve_cla |

Critical Line Algorithm | tickers, min_weight, max_weight |

solve_hierarchical_portfolio |

HRP optimization | tickers, min_weight, max_weight |

solve_black_litterman |

BL with views | tickers, views, risk_aversion |

solve_discrete_allocation |

Weights to shares | tickers, weights, portfolio_value |

solve_cvxpy_problem |

Custom optimization | problem (CVXPY format) |

simple_cvxpy_solver |

Simple custom | variables, objective_expr, constraints |

Common Objectives

minimize_volatility- Lowest risk portfoliomaximize_sharpe_ratio- Best risk-adjusted returnsmaximize_return- Highest expected returnsminimize_cvar- Minimize tail risk

Common Constraints

max_weight 0.3- No asset exceeds 30%min_weight 0.05- Each asset at least 5%max_volatility 0.15- Portfolio volatility ≤ 15%sector_tech 0.4- Tech sector ≤ 40%

For detailed examples and advanced usage, see the Portfolio Optimization Examples section above.